How claims are processed

Before going through the information on your Explanation of Benefits (EOB) statement, it helps to understand how Medicare claims are processed.

Anytime you see a health care provider or receive a health care service, a claim is generated. When you see a provider who accepts Medicare, the claim first goes to Medicare for processing. After Medicare has determined how much it will pay and processed the claim, they send it to your Medicare supplement insurance company (WPS or EPIC) for processing.

Most providers accept Medicare; however, you should always check with them.

If you see a provider that does not accept Medicare assignment, you may have to pay the full bill at time of service. Also, providers that don’t accept Medicare assignment can charge you more than the Medicare-approved amount. Providers that "opt-out" of Medicare will not be paid by Medicare or your Medicare supplement policy, except for emergency services.

About Medicare claims processing

About WPS/EPIC claims processing

How to read your Explanation of Benefits

Your EOB has two main sections:

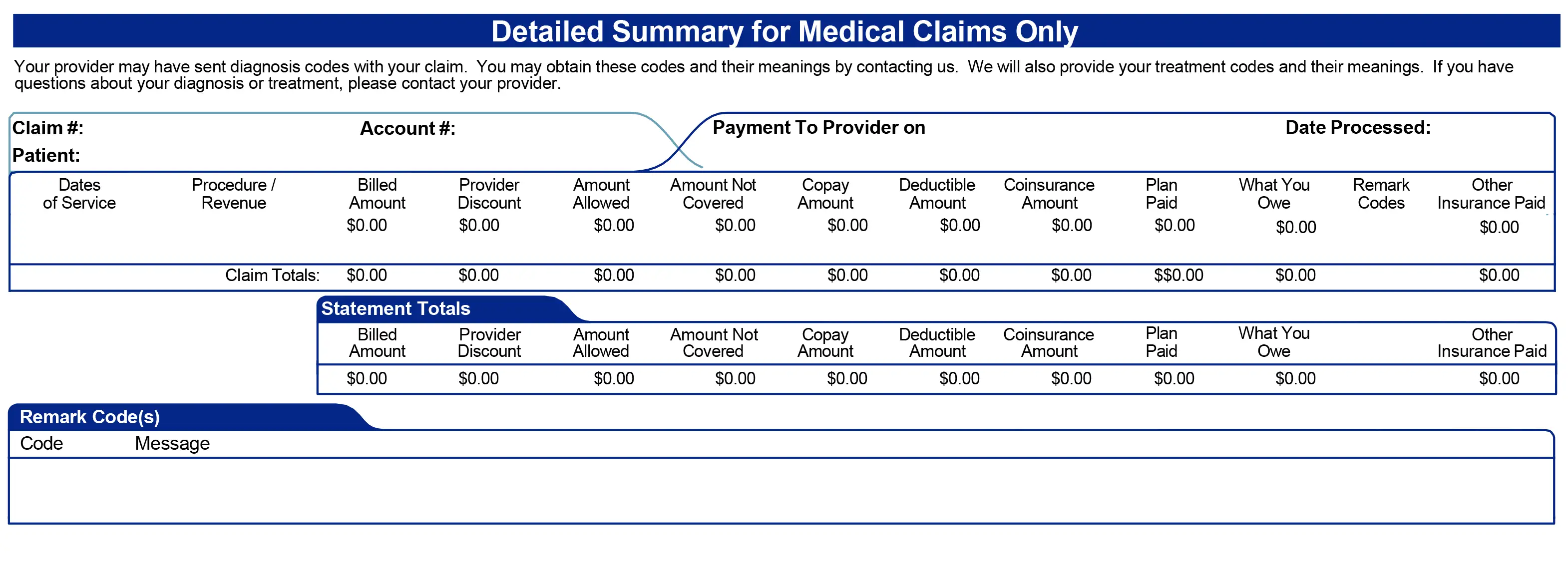

Detailed Summary for Medical Claims Only

This section is your Medicare supplement insurance plan’s explanation of benefits. This is how WPS/EPIC handled the claim after receiving it from Medicare.

About Medicare claims processing

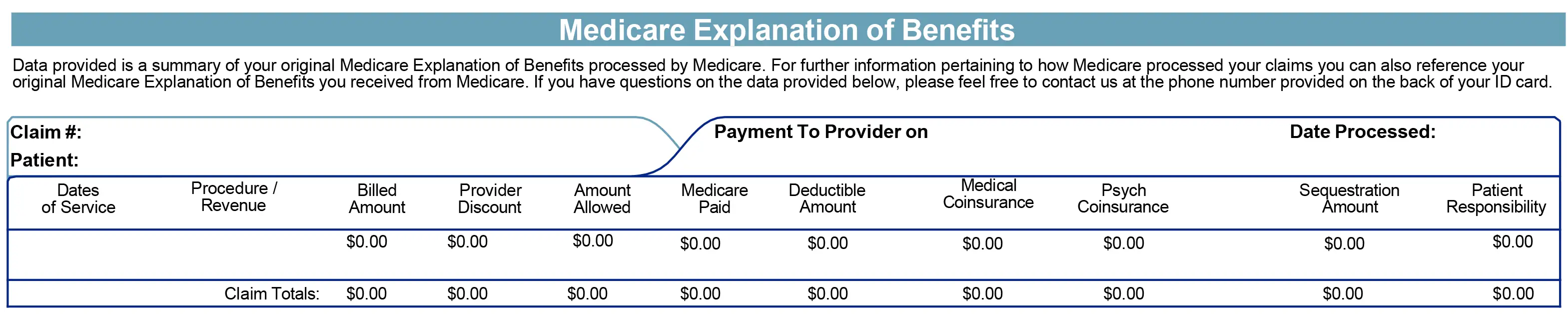

Medicare Explanation of Benefits

This section shows how Medicare handled the claim before sending to WPS/EPIC.

If you have questions not answered here, please call us.

888-253-2694

Monday-Friday, 7:30 a.m. to 5:00 p.m. CT

How to go paperless

If you would like to receive your WPS/EPIC Explanations of Benefits (EOBs) electronically instead of in the mail, you can:

To switch to paperless in your Customer Portal